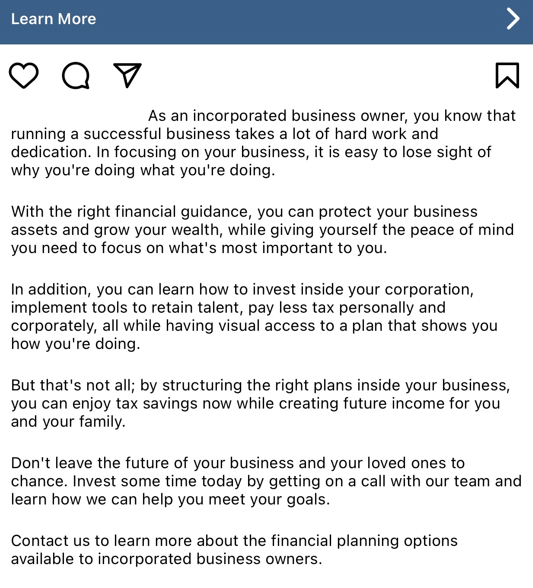

Even though there seems to be no shortage of get rich quick seems, marketing campaigns that fish for insurance leads are getting smarter and smarter. Easy money is an immediate red flag, so with the lack of trust in our institutions, an investment pitch must pivot to appeal to a larger audience. Here is an example of an ad I saw recently on Facebook:

The vast majority of the time, I’d say 99% of the time, these posts push and promote life insurance; how do I know this?

- They want to know that you’re incorporated, as income earned inside a corp is taxed at a lower rate, with passive/investment income taxed at a higher rate; an insurance policy can grow tax free.

- They pitch financial guidance, and peace of mind – advisors and security

- Why do you have to “learn to invest in your corporation”? Can’t you just take your corporate $$, and invest them?

- Visual access – because you’re used to having non-visual access to your investments?

- Tax savings and future income – this is a life insurance/investment hybrid hallmark. Gains inside a life insurance investment aren’t taxes, but you can use it as security for credit/loan in the future, and effectively take $$ out tax free, as long as you pay some interest. This is the primary benefit of corporately owned life insurance but what they don’t share with you, is that these plans are designed for individuals who net more than the Small Business Deduction limit; $500k. These products are for those who want protection and have wealth, not those who are working to create it.

- Chance – the irony here, especially if this is a Participating policy, is that you are leaving it to chance. Keep in mind, dividends arise when the actual experience is more favourable than the assumptions used when the policy was priced, and those assumptions are not disclosed. The insurance companies are well aware of this, but simply won’t share the information; it’s “proprietary”.

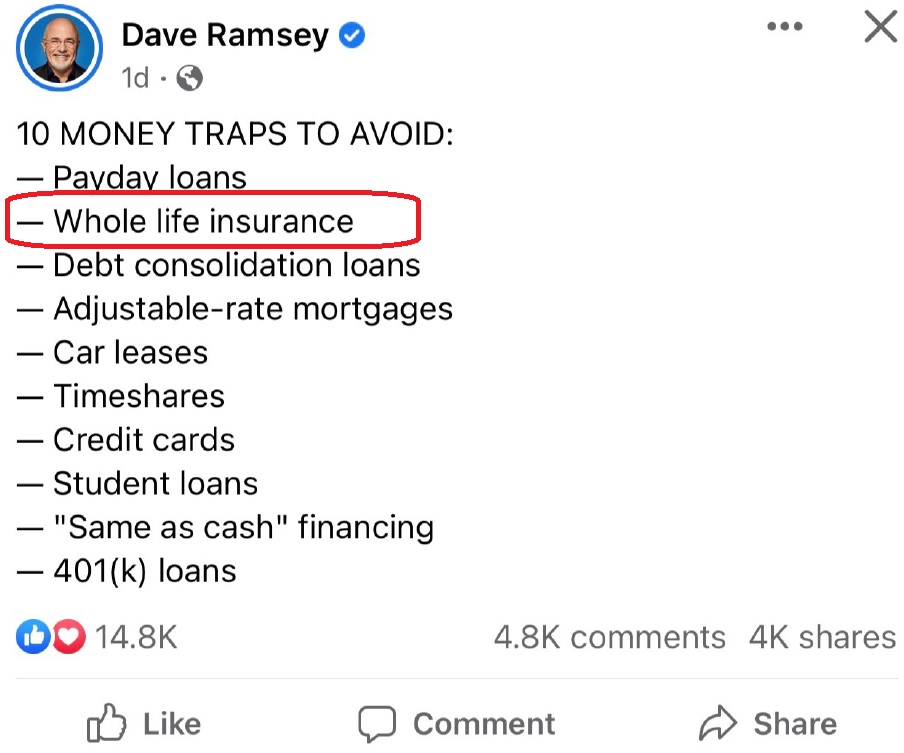

I’ve said this in my book and I’ll say it again here, there is a reason why Dave Ramsay calls who life insurance the “pay-day lender of the middle class”. An investment grade insurance policy, for most, is a poor investment, with little to no transparency, that will provide poor short-term protection, and rob you of your ability to produce wealth long term.

Invest in yourself, invest in your business – feed it so it can eventually feed you. These are products designed by the financial services industry to make money OFF you, not for you. The word “product” comes from the Latin word producere; to “lead or bring forth, draw out”.

They want to draw money out of your pocket, and act like it’s a favor. Based on my experiences, the policy you have in 2050 will look nothing like the one you purchased in 2023.

Buy smart my friends,

-Adam