Ongoing dividends for life. Sounds good, doesn’t it?

Year after year, people ask me how to do it. They’ve heard claims about receiving uninterrupted ‘infinite’ income by purchasing a life insurance policy, specifically, a Participating Life Insurance (PAR) policy. They have dreams of ‘becoming their own banker’ and achieving financial independence, retiring early and living the good life thanks to savvy financial investing in PAR.

As you can probably guess, that’s not the case.

If it was that easy to earn uninterrupted dividends, more people would be doing it. But the truth is, these claims of infinite income rarely stand up to scrutiny: data doesn’t lie.

Working with an experienced financial advisor, who has been around this product for years, is an excellent way to avoid scams and opportunities that seem too good to be true.

What is Participating in Life Insurance?

Participating Life Insurance, better known as PAR, is a form of life insurance that also acts as an investment. Together with other policyholders, your money is invested by the insurance company within their PAR fund. In return, the insurance company pays you a return in the form of a dividend, or a Dividend Scale Interest Rate, better known as a DSIR, at the end of each year. You can choose to accept your dividend in cash, or reinvest it into the policy to continue compounding your return. Top line, it sounds promising.

With the rise of TikTok influencers and Instagram experts, PAR has been popularized as an easy way to invest. Money management approaches like ‘Be Your Own Banker’ (BYOB) and the ‘Infinite Banking Concept’ (IBC) seem simple, and as a basic principle, the idea of not paying interest to a bank for your loans while receiving an annual payout is pretty appealing.

Canadians have approximately $100 billion worth of assets managed within PAR funds, without a strong understanding of how they work.

In my opinion, PAR is one of the most subtle financial misrepresentations today. It’s not a simple way to get rich quick, and there’s a lack of transparency surrounding these products. As a result, advisors have been given carte blanche to over-promise and under-perform. Sadly, it may take decades to know something isn’t right, and by then, you’re stuck.

Borrowing from your PAR and “becoming your own bank”

Throughout life, there may be several reasons you need to borrow money. Purchasing a home, doing a large-scale renovation, paying for post-secondary education, even financing equipment for your business… and there are also different ways to go about it.

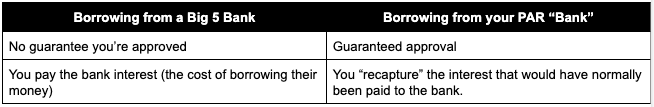

Let’s look at two examples:

Looking at the above chart, it seems obvious: borrowing from your “own” bank is a no-brainer. The BYOB pitch is simple: by borrowing for your PAR policy you’re recapturing the interest you’d normally be paying to the bank. Plus, the PAR fund has provided consistently positive annual returns every year going back to the early 19th century. Since your dividends are uninterrupted, you’ll have “infinite money” to ‘be your own bank’ forever.

This is an over simplistic way of looking at PAR and a wonderful sales strategy. However, the above example completely misrepresents the product because the assumptions underlying your dividend payments are undisclosed and completely proprietary, therefore making it impossible to claim anything is being recaptured.

With that in mind, let’s answer the big question: how do you get paid?

How your dividends are determined

When you purchase a PAR policy, the values reflected in the illustration are based on assumptions/predictions made at the time of purchase. Every year, your dividend is based on the accuracy of those assumptions and whether the assumptions for your policy met or exceeded those expectations. If the combination of returns, claims, expenses, and other factors are more favorable than predicted, a dividend may be issued.

The problem: insurance companies won’t disclose these assumptions, so it’s impossible to know how accurate your illustrations are. In an industry that prides itself on transparency and disclosure, shouldn’t there be rules, laws, or at least a code of conduct about this?

Yes.

Back in 2011, the Office of the Superintendent of Financial Institutions (OSFI) published a document explaining what needs to be disclosed and why. However, if these rules aren’t enforced, they don’t matter. In fact, not one life insurance company in Canada is willing to disclose those proprietary assumptions, making the BYOB/IBC concept a farce. When your returns are 100% based on predictions, morally and ethically, they shouldn’t be proprietary.

A poor track record going back to the 1970s

In the early 2000s, a handful of insurers settled with hundreds of thousands of U.S. and Canadian policy holders for hundreds of millions of dollars. The suit? Deceptive sales practices. In the 1980s and 1990s, insurers and advisors pitched PAR as “vanishing premium” insurance, where dividends would eventually pay you premiums for life. When interest rates were high this wasn’t a problem, but rates fell, premiums returned, and clients demanded compensation.

It’s clear that in the long run, the dividend scales pitched by insurers and advisors alike can’t be trusted—and unfortunately, the complete lack of disclosure continues to this day.

I’ve spent 15 years in financial services, yet only discovered this after a new client asked me to review a policy from 1979. She hadn’t received a dividend in the last six years. I knew dividends weren’t guaranteed, but I didn’t realize a $0 dividend was even possible given the consistent annual returns over the last 100+ years. If I, as a finance professional, discovered this was happening only by chance, what chance does the average consumer have?

The verdict on Participating Life Insurance

Participating Life Insurance has a long history of providing consistent returns to clients, and they do have a place in the market. They’re not all bad, and the companies offering them aren’t all out to pull a fast one. However, even though my client was receiving dividends for most of the policy’s lifespan, it doesn’t discount the fact that we deserve to know how dividends are distributed, and what those underlying assumptions are. When a product is pitched as a retirement investment and policyholders plan on utilizing it 30 – 40 years from now, they deserve transparency.

Nearly every Canadian reading this has a friend or family member with one of these products, and chances are they don’t even know it. Six of Canada’s largest insurance companies manage a combined $81+ billion of your assets, yet refuse to disclose the underlying assumptions your dividends are based on. I personally own two of these policies for my children, and as a member of that fund, deserve full disclosure.

My final thoughts: if you’re sacrificing traditional investing and utilizing Participating Life Insurance as a path to wealth, you’re bound to end up disappointed. My personal and professional recommendation: financial advisors and individuals alike need to stop purchasing PAR policies until companies deliver on transparency. In the end, keep one thing in mind when reviewing your PAR policy: you’re not your own banker, and there’s nothing infinite about it.

The above post includes excerpts from my ebook, Fortune or fiction: why the ‘Be Your Own Banker’ concept is flawed. For more information about Participating Life Insurance and how to navigate the right investment portfolio for you, send me an email anytime.